UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

|

| |

| CELANESE CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

| | | | |

þ | No fee required |

| | |

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) Title of each class of securities to which transaction applies: |

| (2) Aggregate number of securities to which transaction applies: |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) Proposed maximum aggregate value of transaction: |

| (5) Total fee paid: |

|

| | | | |

¨ | Fee paid previously with preliminary materials. |

| | |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) Amount Previously Paid: |

| (2) Form, Schedule or Registration Statement No.: |

| (3) Filing Party: |

| (4) Date Filed: |

|

| | | | |

| Table of Contents |

| LETTER TO SHAREHOLDERS FROM OUR CEO | |

| |

LETTER TO STOCKHOLDERS FROM OUR CHAIRMAN AND CEO | |

| |

LETTER TO STOCKHOLDERSSHAREHOLDERS FROM OUR LEAD INDEPENDENT DIRECTOR | |

| |

VOTING INFORMATION | |

| |

PROXY SUMMARY | |

Annual Meeting Information | |

Roadmap of Voting Matters | |

Governance Highlights | |

Director Nominees | |

Performance and Compensation Decisions | |

Additional Information | |

| |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERSSHAREHOLDERS | |

| |

| VOTING INFORMATION | |

| |

| PROXY STATEMENT SUMMARY | |

| Director Nominees | |

| Director Nominee Highlights | |

| Environmental, Social and Governance Update | |

| Performance Highlights | |

| Additional Information | |

| |

| PROXY STATEMENT | |

| Information About Solicitation and Voting | |

| |

| GOVERNANCE | |

ITEM 1: ELECTION OF DIRECTORS | |

| Director Nominees | |

| Board and Committee Governance | |

| Board Oversight | |

| Shareholder Engagement | |

Additional Governance FeaturesMatters | |

| Director Compensation | |

| Director Independence and Related Person Transactions | |

| | | | | |

| |

| |

| STOCK OWNERSHIP INFORMATION | |

Principal StockholdersShareholders and Beneficial Owners | |

Delinquent Section 16(a) Beneficial Ownership Reporting ComplianceReports | |

| Securities Authorized for Issuance Under Equity Compensation Plans | |

| |

| |

| |

|

| |

| AUDIT MATTERS | |

| Audit Committee Report | |

ITEM 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| |

| EXECUTIVE COMPENSATION* | |

ITEM 2:3: ADVISORY APPROVAL OF EXECUTIVE COMPENSATION | |

| Compensation Discussion and Analysis | |

| Compensation Risk Assessment | |

| Compensation and Management Development Committee Report | |

Compensation Committee Interlocks and Insider Participation | |

| Compensation Tables | |

| |

| CEO Pay Ratio | |

| |

AUDIT MATTERS | |

Audit Committee Report | |

ITEM 3: RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

| |

| |

MANAGEMENT PROPOSAL | |

ITEM 4: APPROVAL OF THE AMENDMENT OF OUR CERTIFICATE OF INCORPORATION

| |

| |

| QUESTIONS AND ANSWERS | |

| Annual Meeting Information | |

| Proxy Materials and Voting Information | |

Annual Meeting Information | |

Company Documents, Communications and StockholderShareholder Proposals | |

| |

| EXHIBIT A | |

| Non-U.S. GAAP Financial Measures | |

| |

EXHIBIT B | |

Amendment to Certificate of Incorporation | |

| |

| |

* Additional detailDetailed table of contents for compensation topics on page 3444. |

| | | | | | | | | | | | | | |

Cautionary Note Regarding Forward-Looking Statements; Available Information This Proxy Statement includes estimates, projections, statements relating to our business plans, objectives, and expected operating results that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may appear throughout this Proxy Statement. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties that may cause actual results to differ materially. We describe risks and uncertainties that could cause actual results and events to differ materially in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of our Forms 10-K and 10-Q. We undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events, or otherwise.

References to our website in this Proxy Statement are provided as a convenience, and the information on our website is not, and shall not be deemed to be a part of this Proxy Statement or incorporated into any other filings we make with the SEC. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers, including Celanese Corporation, that electronically file with the SEC at http://www.sec.gov. |

|

| | | | | | | |

| | Celanese 20192022 / Notice of Annual Meeting and Proxy Statement / i |

|

| | | | | | | | | | | | | | | | | | | |

| | | | A letter from Mark C. Rohr,Lori J. Ryerkerk, our Chairman and CEO | |

March 10, 2022

March 8, 2019

Dear Fellow Stockholders:Shareholders:

As I reflect on 2021 and the first part of 2022, I am pleasedproud of what Celanese was able to invite youaccomplish for its customers, employees and shareholders in the face of many hurdles. To me, it speaks to attend the 2019 Annual Meeting of Stockholders of Celanese Corporation to be held at 7:00 a.m. (Central Daylight Saving Time) on Thursday, April 18, 2019. This year’s Annual Meeting will be held at The Westin Irving Convention Center at Las Colinas, 400 West Las Colinas Blvd., Irving, Texas 75039.

The following Notice of Annual Meeting of Stockholders and Proxy Statement includes information about the matters to be acted upon by stockholders. Celanese also has made available with this Proxy Statement a copypower of our 2018 Annual Report. business model and our culture.

We encourage you to readstarted the year seeing recovery across all of our Annual Report, which includesbusinesses, but also witnessing a resurgence of COVID globally. The question of how fast the recovery would be was first and foremost in our audited financial statementsminds, and additional information about the business. Celanese has madeyear brought challenges almost immediately.

With its unanticipated magnitude, the proxy materials available viaFebruary 2021 deep freeze in the internet. The Company believes that providing internet accessU.S. Gulf Coast shut down our Texas facilities, stressed all of our operations and supply chains globally, and dealt personal hardships to our proxy materials increasesemployees in Texas. Throughout the abilityrest of the year our business was tested by global transportation and logistics disruption, energy curtailments in China, the global semiconductor chip shortage, and rapidly-increasing raw material and energy costs.

We faced all of these hurdles while continuing to prioritize the safety of our stockholdersemployees during an ever-evolving global pandemic and delivered record business and financial results. Our key victories in 2021 and early 2022 in advancing business and sustainability include:

•growing through our strategic imperatives, innovation and customer success;

•publishing a comprehensive sustainability report, Elements of Opportunity;

•announcing a goal to review important Company information, while reducingreduce our Scope 1 and 2 greenhouse gas intensity 30% by 2030;

•advancing our strategy through high-value acquisitions including the environmental impactSantoprene business (closed December 2021) and the majority of DuPont’s Mobility & Materials business (announced February 2022 and scheduled to close around the end of 2022); and

•caring for our Annual Meeting.people and communities.

At Celanese, we are committed to effective corporate governance. To that end, both management and our boardOur team is proud of directors regularly evaluate matters relating to our corporate governance profile. Based on our ongoing assessment of governance best practices and discussions with our stockholders, in February 2016, we made two major changes – our board of directors proactively adopted “proxy access” amendments to the Company’s by-laws to enable eligible stockholders to include qualifying director nominees in the Company’s proxy materials for its annual meeting of stockholders, subject to the terms and conditions specified in the by-laws. In addition, our board of directors recommended, and stockholders approved, a proposal to transition to an annually elected board of directors. Beginning with the 2019 Annual Meeting, all directors will be elected annually. We will continue to monitor, and assess the value of, corporate governance developments to the Company and to you.

We hope that you will participate in the Annual Meeting, either by attending and voting in person or by voting through the other acceptable methods described in the Proxy Statement. You may submit your proxy via the internet, by phone, or by signing, dating, and returning the enclosed proxy card (or voting instruction form, if you hold shares through a broker). If you decide to attend the Annual Meeting, you will be able to vote in person, even if you have previously submitted your proxy. Please review the instructions on each of your voting optionsaccomplishments described in this Proxy StatementStatement. We worked with resiliency and grit to deliver record 2021 adjusted earnings per share and free cash flow while returning significant capital to shareholders and advancing our sustainability journey, as wellyou can read about in more detail in these pages. A special thank you to Celanese employees for their dedication and efforts.

Please join our Board of Directors and executive officers on April 20, 2022, at 1:00 p.m. Central time, when we hold our Annual Meeting of Shareholders in live virtual format. Your vote is very important, and whether or not you are able to attend the event in real time, we encourage you submit your voting instructions by proxy as described in the Noticethis document. We look forward to your participation.

Thank you received in the mail or via email.

On behalf of the board of directors, I would like to express our appreciation for your continued support of Celanese. I look forward to seeing you at the Annual Meeting.

Sincerely,

Mark C. RohrLori J. Ryerkerk

Chairman and Chief Executive Officer

|

| | | | | | | |

| | Celanese 20192022 / Notice of Annual Meeting and Proxy Statement / 1 |

|

| | | | | | |

| | | | A letter from Edward G. Galante, our Lead Director | |

March 8, 2019

Dear Fellow Stockholders:

As the Lead Independent Director of your board of directors, I am honored to have the opportunity to write to you, our stockholders, as part of this year’s Proxy Statement. The Proxy Statement affords us the opportunity to reach out to all of Celanese’ stockholders to review, among many other things, where the Company has been and where we are going. Our board is committed to executing its governance responsibilities and providing appropriate oversight of the Company’s operations, long-term strategy and risk exposure.

Over the past few years, we have enhanced our proxy statement to make it clearer, simpler and more straightforward with a focus on what matters most to stockholders. This includes providing a better understanding of our strategy, corporate governance and executive compensation. We hope the following pages will help you better understand the Company and how our governance and compensation practices are linked to performance and accountability in a manner that drives long-term stockholder value. As overseers of the Company, it is the board’s responsibility to remain highly engaged in the Company’s strategic approach to creating value for our share owners and, correspondingly, to actively manage the Company’s enterprise risks. We appreciate your feedback and look forward to a meaningful engagement on issues that are important to all of us.

Over the last few years, Celanese also has enhanced its stockholder outreach program. Throughout the period, the Company held multiple meetings with stockholders and proactively reached out to stockholders on an individual basis to solicit their feedback on topics of importance to stockholders. During 2018, we held meetings with stockholders owning collectively more than 50% of our stock. The board remains very focused on the Company’s strategic initiatives to strengthen financial performance, which in turn will foster long-term sustainable growth for our stockholders.

The board has also been focused on governance and board composition. As noted by our Chairman, during 2016 our board of directors proactively adopted proxy access and, based on stockholders’ comments and vote in April 2016, we have phased out our classified board structure. In addition to these developments, we continue to maintain our focus on key governance practices that we understand are important to stockholders. Notably, almost one-half of our directors have joined our board in the past five years, bringing with them fresh perspectives and a diversity of experiences, and one-third of our directors are female. These new directors have allowed us to rotate directors among committees. As of the 2018 Annual Meeting, 75% of our standing committees were chaired by directors new to Celanese in the last five years.

On behalf of the board of directors, I would like to express our sincere appreciation for the trust you have placed in us, and we look forward to serving you throughout the upcoming year.

Sincerely,

Edward G. Galante

Lead Independent Director

|

| | |

| Celanese 2019 / Notice of Annual Meeting and Proxy Statement / 2 |

VOTING INFORMATION

It is very important that you vote in order to play a part in the future of the Company. Please carefully review the proxy materials for the 2019 Annual Meeting of Stockholders (“Annual Meeting”) and follow the instructions below to cast your vote on all of the voting matters.

Who is Eligible to Vote

You are entitled to vote at the Annual Meeting if you were a stockholder of record at the close of business on February 19, 2019, the record date for the meeting. On the record date, there were 127,843,230 shares of the Company’s Common Stock issued, outstanding and entitled to vote at the Annual Meeting.

How to Vote

Even if you plan to attend the Annual Meeting in person, please submit your voting instructions by proxy right away using one of the following methods for submitting a proxy (see page 83 for additional details). Make sure to have your proxy card, voting instruction form or notice of internet availability in hand and follow the instructions.

|

| | | | | | | | | | |

VOTE IN ADVANCE OF THE MEETING | | VOTE IN PERSON |

| | | | | | | | | | |

via the internet | | by phone | | by mail | | in person |

: | | ) | | * | | m |

| | |

Visit proxyvote.com to submit a proxy via computer or your mobile device | | Call 1-800-690-6903 or the telephone number on your proxy card or voting instruction form | | Sign, date and return your proxy card or voting instruction form | | |

| | |

If you have questions or require assistance with voting your shares, or if you need additional copies of the proxy materials, please contact Alliance Advisors, LLC, 200 Broadacres Drive, 3rd Floor, Bloomfield, New Jersey 07003. Stockholders may call toll free: (855) 486-7908.

All stockholders of record may vote in person at the Annual Meeting. Beneficial owners may vote in person at the Annual Meeting if they have a legal proxy, as described in the response to question 20 on page 89.Important Note About Meeting Admission Requirements: If you plan to attend the meeting in person, see the answer to question 19 on page 88 for important details on admission requirements. |

| | | | | |

| | | | | |

| Electronic Stockholder Document Delivery | |

| Instead of receiving future copies of annual meeting proxy materials by mail, stockholders of record and most beneficial owners can elect to receive an e-mail that will provide electronic links to these documents. Opting to receive your proxy materials online will save us the cost of producing and mailing documents and will also give you an electronic link to the proxy voting site. |

|

|

| | | | | |

|

| | |

| Celanese 2019 / Notice of Annual Meeting and Proxy Statement / 3 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2019 PROXY SUMMARY | | |

| This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider. You should read the entire Proxy Statement carefully before voting. For more complete information regarding the Company’s 2018 performance, please review our 2018 Annual Report, which includes the Company’s Annual Report on Form 10-K for the year ended December 31, 2018. | | |

| Annual Meeting Information | | |

| | | |

| Date and Time | | April 18, 2019 | 7:00 a.m. (Central Daylight Saving Time) | | |

| Place | | The Westin Irving Convention Center at Las Colinas

400 West Las Colinas Blvd., Irving, TX 75039 | | |

| Record DateA letter from William M. Brown, our Lead Director | | February 19, 2019 | | |

| Voting | | Stockholders as of the record date are entitled to vote. Each share of Common Stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. | | |

| Entry | | If you decide to attend the meeting in person, upon your arrival you will need to register as a visitor. See ”Questions and Answers” for further instructions. | | |

| | | |

| Roadmap of Voting Matters | |

| | |

| Stockholders are being asked to vote on the following matters at the Annual Meeting: | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Our Board’s Recommendation | |

| ITEM 1. Election of Directors (page 9) | | | | | | | | | | | |

| The board and the nominating and corporate governance committee believe that the nine director nominees possess the necessary qualifications to provide effective oversight of the business and quality advice and counsel to the Company’s management. | FOR each Director Nominee | |

| ITEM 2. Advisory Approval of Executive Compensation (page 35) | | | | | | | | | | | |

| The Company seeks a non-binding advisory vote to approve the compensation of certain executive officers, as described in the Compensation Discussion and Analysis beginning on page 36 and in the Compensation Tables beginning on page 61. The board values stockholders’ opinions and the compensation and management development committee will take into account the outcome of the advisory vote when considering future executive compensation decisions. | FOR | |

| ITEM 3. Ratification of Independent Registered Public Accounting Firm (page 79) | | | | | | | | | | | |

| The audit committee and the board believe that the continued retention of KPMG LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019 is in the best interests of the Company and its stockholders. As a matter of good corporate governance, stockholders are being asked to ratify the audit committee’s selection of the independent registered public accounting firm for 2019. | FOR | |

| ITEM 4. Approval of the Amendment of our Certificate of Incorporation (page 81) | | | | | | | | | | | |

| The Company seeks approval of an amendment of our Certificate of Incorporation regarding removal of directors. | FOR | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

March 10, 2022

Dear Fellow Shareholders:

As the Lead Independent Director of the Board of Directors, I am honored to have the opportunity to write to our shareholders to review some of the highlights of Celanese’s 2021 efforts and accomplishments in advance of our upcoming Annual Meeting of Shareholders.

The Board is pleased with Celanese’s accomplishments in 2021: record financial performance, continued execution against its long-term strategy, and accomplishment of significant milestones on Celanese’s continuing environmental, social and governance (ESG) journey. In last year’s Proxy Statement, we communicated to you about the Board’s and management’s purposeful efforts during a difficult and unprecedented 2020 to protect our people and business and to position Celanese for recovery. We believe Celanese’s 2021 results and progress demonstrate the success of those efforts.

Through our shareholder outreach program, we have heard from our investors a high level of interest in Celanese’s work to promote a more sustainable world through addressing the threat of climate change and fostering a diverse and inclusive workforce, as well as how the Board oversees Celanese’s ESG initiatives. As detailed in these pages, the Board and management have responded to our shareholders by making thoughtful, deliberative progress in these areas.

The Board’s deep commitment to ESG progress is reflected in its 2021 adoption of a detailed and formalized approach to overseeing ESG priorities through its Committees and the full Board. This updated framework is described in “Governance - Board Oversight of Environmental, Social and Governance Matters”. Some of Celanese’s key accomplishments during 2021 and early 2022 are also described beginning on page 7. These efforts are overseen by a Board representing variety of viewpoints and experience. Through thoughtful refreshment, the Board has added five new directors in the last five years, most recently adding Rahul Ghai, an experienced financial executive, and Michael Koenig, a long-time materials industry executive. Three of these directors added in the last five years are women and two are racially diverse. The Board believes this mix of fresh perspectives is an effective complement to the experience and knowledge of our longer-serving directors. We are committed to continuous improvement in the diversity of our leadership and our organization.

Your Board remains committed to effective oversight of the Company’s operations, long-term strategy and risk management to foster long-term sustainable growth for our shareholders. On behalf of the Board of Directors, I would like to express our sincere appreciation for the trust that Celanese shareholders have placed in us, and we look forward to continuing to serve you throughout the upcoming year.

Sincerely,

William M. Brown

Lead Independent Director

|

| | |

| Celanese 2019 / Notice of Annual Meeting and Proxy Statement / 4 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Governance Highlights | | |

| | We are committed to good corporate governance, which promotes the long-term interests of stockholders, strengthens board and management accountability and helps build public trust in the Company. The Governance section beginning on page 9 describes our governance framework, which includes the following highlights: | | |

| | • Independent lead director | • Active stockholder engagement | | | |

| | • 8 of our 9 directors are independent | • Diverse board in terms of gender, experience and skills | | |

| | • Board committees consist entirely of independent directors | • Director retirement guideline | | |

| | • Independent directors meet without management present | • Restrictions on share hedging and pledging | | |

| | • Annual board self-assessment process | • Share ownership guidelines for executives and directors | | |

| | • Majority voting for all directors | • Longstanding commitment to corporate responsibility | | |

| | • Proxy access, under which up to 20 stockholders owning collectively 3% of our stock may nominate 20% of our directors | • Policy providing for return of long-term incentive compensation under certain circumstances (clawback policy) | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Director Nominees | | |

| | The following table provides summary information about each director nominee. Each nominee is to be elected by a majority of the votes cast. See “Item 1: Election of Directors”and “Director Nominees”, for additional information about the nominees and the other directors continuing in office. | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Name and Qualifications | Age | Director Since | Primary Occupation / Other Public Company Boards | Independent | Committee Memberships | |

| | Jean S. Blackwell | 64 | 2014 | Former EVP/CFO – Cummins Inc. | ü | CMD; NCG£ | |

| | &5ÂGq@L | | | Ingevity Corp.; Johnson Controls Int’l plc | | | |

| | William M. Brown | 56 | 2016 | Chairman/President/CEO Harris Corp. | ü | AC; EHS | |

| | &:5ÂG@6LQq | | | Harris Corp. | | | |

| | Edward G. Galantet | 68 | 2013 | Former SVP – Exxon Mobil Corporation | ü | CMD; NCG | |

| | &Q.:ÂGq@6L | | | Linde plc; Clean Harbors Inc.; Marathon Petroleum Corp. | | | |

| | Kathryn M. Hill | 62 | 2015 | Former SVP Dev. Strategy – Cisco Systems Inc. | ü | CMD£; EHS | |

| | &Q:5@6 | | | Moody’s Inc.; NetApp Inc. | | | |

| | David F. Hoffmeister | 64 | 2006 | Former SVP / CFO – Life Technologies Corp. | ü | AC; NCG | |

| | .Â6&Q:GqL | | | Glaukos Corporation; ICU Medical Inc. | | | |

| | Dr. Jay V. Ihlenfeld | 67 | 2012 | Former SVP, Asia Pacific - 3M Company | ü | CMD; EHS£ | |

| | Q.:5G@6 | | | Ashland Global Holdings, Inc. | | | |

| | Mark C. Rohr | 67 | 2007 | Chairman & Chief Executive Officer – Celanese Corp. | | – | |

| | &Q:5Gq@6L. | | | Ashland Global Holdings, Inc. | | | |

| | Kim K.W. Rucker | 52 | 2018 | Former EVP and GC, Andeavor | ü | AC; EHS | |

| | &Q5:Gq6L | | | Lennox International Inc.; Marathon Petroleum Corp. | | | |

| | John K. Wulff | 70 | 2006 | Former Chairman – Hercules Inc. | ü | AC£; NCG | |

| | &.:ÂGq6L | | | Atlas Air Worldwide Holdings, Inc. | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Board Committees: | | Qualifications: | | | | | |

| | AC | Audit Committee | | & | Leadership | | G | Govt/regulatory | | |

| | CMD | Compensation and Management Development Committee | | Q | Global experience | | q | Financial transactions | | |

| | EHS | Environmental, Health, Safety, Quality and Public Policy Committee | | . | Chemical industry | | @ | Operational | | |

| | NCG | Nominating and Corporate Governance Committee | | : | Innovation-focused | | 6 | Strategic | | |

| | £ | Committee Chair | | 5 | Customer-focused | | L | Risk oversight | | |

| | t | Lead Independent Director | | Â | Financial experience | | | | | |

|

| | |

| Celanese 20192022 / Notice of Annual Meeting and Proxy Statement / 52 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Performance and Compensation Decisions | |

| | |

| 2018 Key Performance Highlights | |

| Business Performance | |

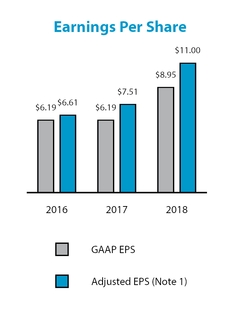

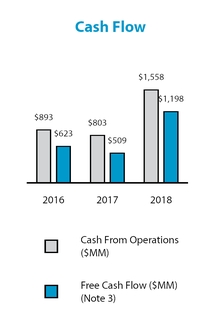

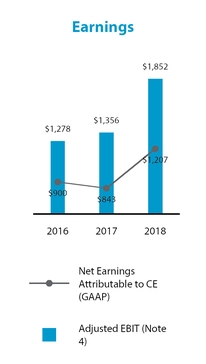

| In 2018, our key performance metrics were as follows: | |

| • Net sales were $7.2 billion, up 16.5% | |

| • Cash from operations was $1.56 billion while free cash flow(1) was $1.20 billion

| |

| • Net earnings was $1.2 billion while Adjusted EBIT(1) was $1.85 billion, up 36.6%

| |

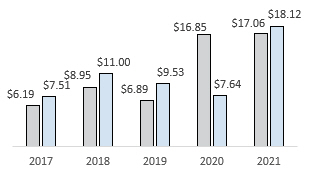

| • GAAP earnings per sharewas $8.95, up 44.6%, while adjusted earnings per share(1) was $11.00, an increase of 46.5% over 2017

| |

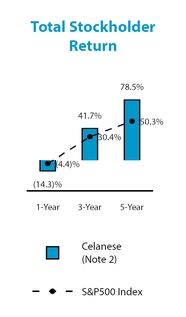

| Stockholder Value Creation | |

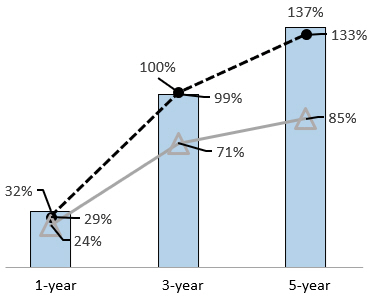

| • Positive three- and five-year total stockholder return of 41.7% and 78.5%, exceeding the S&P500 Index | |

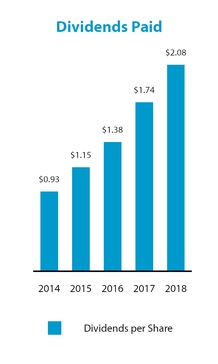

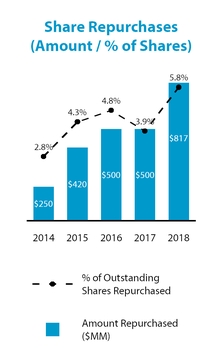

| • Returned a record $1.1 billion to stockholders through dividends and share repurchases | |

| • Increased the quarterly cash dividend rate by 17.4% in 2018 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

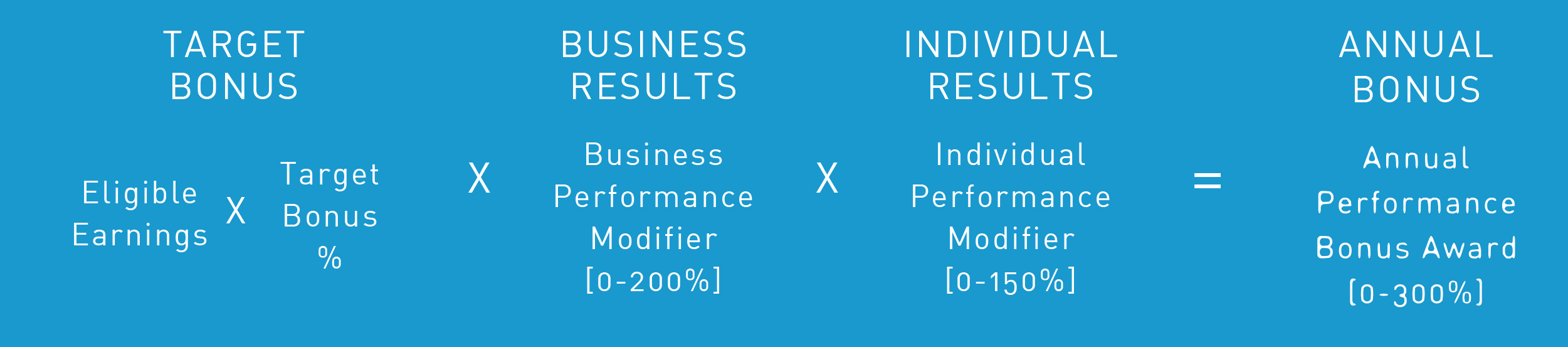

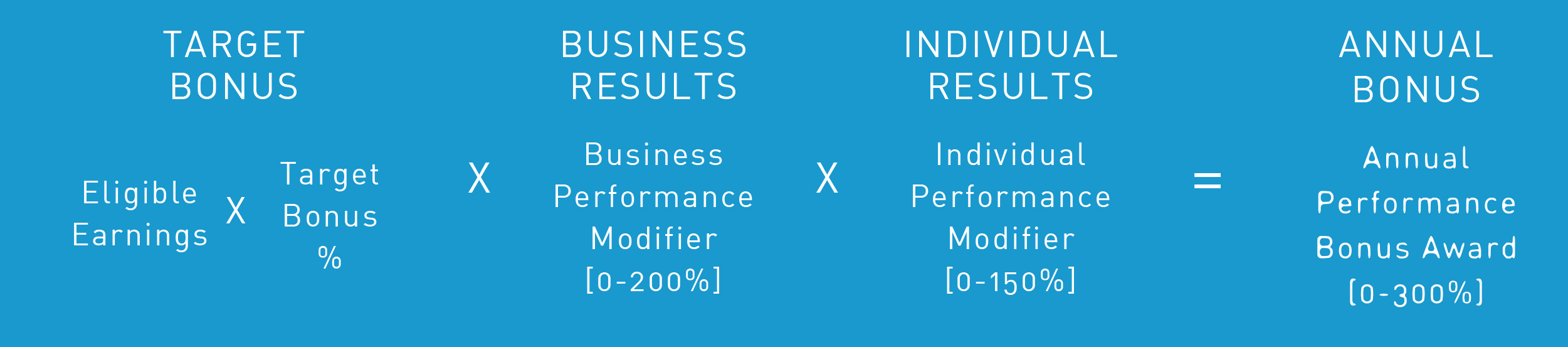

| How Pay is Aligned to 2018 Company Performance | |

| The operation of our variable incentives demonstrates strong linkage between pay and performance. See page 50 for the detailed performance results. | |

| • Annual Incentive – 2018 performance resulted in above target achievement on our financial and stewardship objectives established at the beginning of the year under our 2018 annual incentive plan | |

| • Long-Term Incentive – The performance-based restricted stock units (“PRSUs”) granted in 2016, based on our Adjusted EBIT(1) and Return on Capital Employed over a 2016-2018 performance period will pay out at 199.2% of target

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2018 Key Compensation Decisions | |

| • 2018 Compensation – Based on our 2018 performance, the compensation and management development committee approved a business performance modifier of 161% under our 2018 annual incentive plan and established individual performance modifiers for the named executive officers. In addition, the committee had earlier awarded PRSUs and time-based restricted stock units in February 2018 under our 2018 long-term incentive plan. See page 49 for more information. | |

| | |

| Key Compensation Features | |

| • No employment agreements | |

| • Change in control double-trigger equity awards (participant’s employment must be terminated to receive benefits) | |

| • Clawback, no share hedging and no pledging policies | |

| • No tax gross-ups of severance, change-in-control payments or perquisites, other than for relocation benefits | |

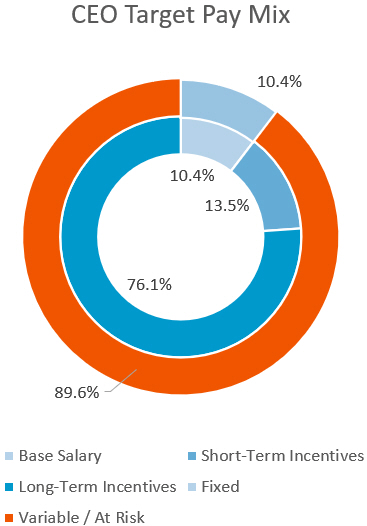

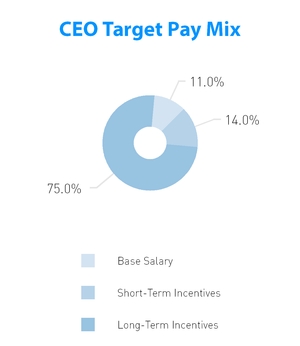

| • A high percentage of compensation is at risk (i.e., tied to performance) | |

| • Significant executive share ownership requirements | |

| | |

| Additional Information | |

| Please see “Questions and Answers” beginning on page 83 for important information about the proxy materials, voting, the Annual Meeting, Company documents, communications and the deadlines to submit stockholder proposals for the 2019 Annual Meeting of Stockholders. | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | |

| (1) Free cash flow, Adjusted EBIT and adjusted earnings per share are non-U.S. GAAP financial measures. See “Exhibit A” for information concerning these measures including a definition and a reconciliation to the most comparable U.S. GAAP financial measure. | |

|

| | |

| Celanese 2019 / Notice of Annual Meeting and Proxy Statement / 6 |

|

| | | | | | |

| | | | Notice of Annual Meeting of StockholdersShareholders | |

CELANESE CORPORATION

222 W. Las Colinas Blvd., Suite 900N

Irving, Texas 75039

|

| |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERSSHAREHOLDERS |

|

| | | | | | | |

| Date and Time: | | April 18, 2019, 7:20, 2022, 1:00 a.m.p.m. (Central Daylight Saving Time) |

Place:Virtual Meeting Website: | | The Westin Irving Convention CenterOnline at Las Colinas

400 West Las Colinas Blvd., Irving, Texas 75039

www.virtualshareholdermeeting.com/CE2022 |

| Items of Business: | | ● To elect Jean S. Blackwell, William M. Brown, Edward G. Galante, Rahul Ghai, Kathryn M. Hill, Dr. Jay V. Ihlenfeld, David F. Hoffmeister, Mark C. Rohr,Deborah J. Kissire, Michael Koenig, Kim K.W. Rucker and John K. WulffLori J. Ryerkerk to serve until the 20202023 Annual Meeting of Stockholders,Shareholders, or until their successors are elected and qualified or their earlier resignation; |

| | ●Advisory vote to approve executive compensation;

|

| | ● To ratify the selection of KPMG LLP as our independent registered public accounting firm for 2019;2022; |

| | | ● To hold an advisory vote to approve an amendment to our certificate of incorporation;executive compensation; and |

| | |

| | | ● To transact such other business as may properly be brought before the meeting in accordance with the provisions of the Company’s FifthSixth Amended and Restated By-laws (the “by-laws”). |

| Record Date: | | You are entitled to attend the 2022 Annual Meeting virtually and to vote if you were a stockholder of record as ofshareholder at the close of business on February 19, 2019.22, 2022. |

Our Proxy Statement follows. FinancialThis year’s Annual Meeting will be held as a “virtual meeting” via the Internet at www.virtualshareholdermeeting.com/CE2022. You will be able to vote and other information about Celanese Corporation are contained in oursubmit questions online through the virtual meeting platform during the Annual Report to Stockholders for the fiscal year ended December 31, 2018 (“2018 Annual Report”), which accompanies the Proxy Statement.Meeting.

To ensure that your shares are represented at the meeting, we urge you to submit your voting instructions by proxy as promptly as possible. You may submit your proxy via the Internet or telephone, or, if you received paper copies of the proxy materials by mail, you can also submit a proxy via mail by following the instructions on the proxy card or voting instruction card. We encourage you to submit a proxy via the Internet. It is convenient and saves us significant postage and processing costs. You can revoke a proxy at any time prior to its exercise at the Annual Meeting by following the instructions in the Proxy Statement.

By Order of the Board of Directors of

Celanese Corporation

James R. Peacock IIIA. Lynne Puckett

Senior Vice President, Deputy General Counsel

and Corporate Secretary

Irving, Texas

March 8, 2019

|

| | | | | | | | | | | | | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERSSHAREHOLDERS TO BE HELD ON APRIL 18, 201920, 2022 |

The Celanese Corporation 20192022 Notice of Annual Meeting and Proxy Statement, 20182021 Annual Report and other proxy materials are available at www.proxyvote.com. |

|

| | | | | | | |

| | Celanese 20192022 / Notice of Annual Meeting and Proxy Statement / 3 |

VOTING INFORMATION

You are invited to attend the Annual Meeting to be held at 1:00 p.m. (Central Daylight Saving Time) on Wednesday, April 20, 2022. This year’s Annual Meeting will be held as a “virtual meeting” via the Internet at www.virtualshareholdermeeting.com/CE2022.

It is very important that you vote in order to play a part in the future of the Company. Please carefully review the proxy materials for the Annual Meeting and follow the instructions below to cast your vote on all of the voting matters.

Who is Eligible to Vote

You are entitled to vote at the Annual Meeting if you were a shareholder at the close of business on February 22, 2022, the record date for the meeting. On the record date, there were 108,029,267 shares of the Company’s Common Stock issued, outstanding and entitled to vote at the Annual Meeting.

How to Vote

Even if you plan to attend the Annual Meeting, please submit your voting instructions by proxy right away using one of the following methods for submitting a proxy (see page 89 for additional details). Make sure to have your proxy card, voting instruction form or Notice of Internet Availability in hand and follow the instructions. Unless those documents provide different instructions, most of our shareholders will be able to vote in advance of the meeting by one of the following means: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| VOTE IN ADVANCE OF THE MEETING* | | VOTE AT THE VIRTUAL MEETING |

| | | | | | | | | |

| via the internet | by phone | by mail | by QR code | | |

| : | ) | * | | | m |

|

| Visit proxyvote.com to submit a proxy via computer or your mobile device | Call 1-800-690-6903 or the telephone number on your proxy card or voting instruction form | Sign, date and return your proxy card or voting instruction form | Scan this QR code to vote with your mobile device (may require free app) | | |

|

* You will need the 16-digit control number included on your proxy card, voting instruction form or Notice of Internet Availability of Proxy Materials.

If you have questions or require assistance with voting your shares, or if you need additional copies of the proxy materials, please contact Alliance Advisors, LLC, 200 Broadacres Drive, 3rd Floor, Bloomfield, New Jersey 07003. Shareholders may call toll free: (800) 574-5971.

Important Note About Meeting Admission Requirements: If you plan to attend the virtual meeting, see the answer to question 2 on page 87 for important details on requirements to log-in to the meeting. | | | | | | | | | | | | | | |

| | | | |

| Electronic Shareholder Document Delivery | |

| Instead of receiving future copies of annual meeting proxy materials by mail, shareholders of record and most beneficial owners can elect to receive an e-mail that will provide electronic links to these documents. Opting to receive your proxy materials online will save us the cost of producing and mailing documents and will also give you an electronic link to the proxy voting site. |

|

|

| | | | |

| | | | | | | | |

| Celanese 2022 / Notice of Annual Meeting and Proxy Statement / 4 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| PROXY STATEMENT SUMMARY | We provide below highlights of certain information in this Proxy Statement. As this is only a summary, please refer to the complete Proxy Statement and 2021 Annual Report before you vote.

| |

| | | |

| Proxy Item No. 1 Election of 11 Director Nominees | ü The Board recommends a vote FOR all Director Nominees Our Board and the Nominating and Corporate Governance Committee believe that the eleven director nominees possess the necessary qualifications to provide effective oversight of the business and quality advice and counsel to the Company’s management.

| |

| | | | | | | | | | | | | | | | | | | | | |

| Director Nominees | | |

| The following table provides summary information about each director nominee. Each nominee is to be elected by a majority of the votes cast. | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Qualifications | Age | Director Since | Primary Occupation / Other Public Company Boards | Independent | Committee Memberships(1) | |

| | | | | | | |

| Jean S. Blackwell | 67 | 2014 | Former EVP / CFO – Cummins Inc. | ü | AC; NCG | |

| &Q5ÐGq@6L | | | Ingevity Corp.; Johnson Controls Int’l plc | | | |

| William M. Brown | 59 | 2015 | Executive Chair – L3Harris Technologies, Inc. | ü | CMD; NCGt | |

| &Q:5Gq@6L | | | Becton, Dickinson and Company | | | |

| Edward G. Galante | 71 | 2013 | Former SVP – Exxon Mobil Corporation | ü | CMD£; EHS | |

| &Q.:ÐGq@6L | | | Linde plc; Clean Harbors Inc.; Marathon Petroleum Corp. | | | |

| Rahul Ghai | 50 | 2022 | Chief Financial Officer – Otis Worldwide Corporation | ü | AC; NCG | |

| &Q:Gq@6L | | | | | | |

| Kathryn M. Hill | 65 | 2015 | Former SVP Dev. Strategy – Cisco Systems Inc. | ü | CMD; EHS£ | |

| &Q:5@6 | | | Moody’s Corporation; NetApp Inc. | | | |

| David F. Hoffmeister | 67 | 2006 | Former SVP / CFO – Life Technologies Corp. | ü | AC; NCG | |

| &Q.:Gq6L | | | Glaukos Corporation; ICU Medical Inc.; StepStone Group Inc. | | | |

| Dr. Jay V. Ihlenfeld | 70 | 2012 | Former SVP, Asia Pacific – 3M Company | ü | CMD; EHS | |

| Q.:5ÐG@6 | | | Ashland Global Holdings, Inc. | | | |

| Deborah J. Kissire | 64 | 2020 | Former Vice Chair - Ernst & Young LLP | ü | AC£; EHS | |

| &Q:5Gq6L | | | Omnicom Group; Axalta Coatings System Ltd.; Cable One, Inc. | | | |

| Michael Koenig | 58 | 2022 | Chief Executive Officer – Nobian Industrial Chemicals B.V. | ü | CMD; EHS | |

| &Q.:5ÐG@6L | | | Symrise AG | | | |

| Kim K.W. Rucker | 55 | 2018 | Former EVP and GC – Andeavor | ü | AC; NCG£ | |

| &Q:5ÐGq6L | | | Lennox International Inc.; Marathon Petroleum Corp.; HP Inc. | | | |

| Lori J. Ryerkerk | 59 | 2019 | Chairman, Chief Executive Officer – Celanese Corporation | | – | |

| &Q.:ÐGq@6L | | | Eaton Corporation plc | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Qualifications: | | | | | | | | Board Committees: | | | | | |

| & | Leadership | | G | Govt/regulatory | | AC | Audit Committee | | |

| Q | Global experience | | q | Financial & transactions | | CMD | Compensation and Management Development Committee | | |

| . | Chemical industry | | @ | Operational | | EHS | Environmental, Health, Safety, Quality and Public Policy Committee |

| : | Innovation-focused | | 6 | Strategic | | NCG | Nominating and Corporate Governance Committee | | |

| 5 | Customer-focused | | L | Risk oversight | | £ | Committee Chair | | |

| Ð | Environmental / sustainability | | | | t | Lead Independent Director | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Celanese 2022 / Notice of Annual Meeting and Proxy Statement / 5 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

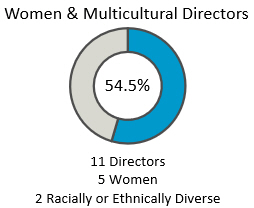

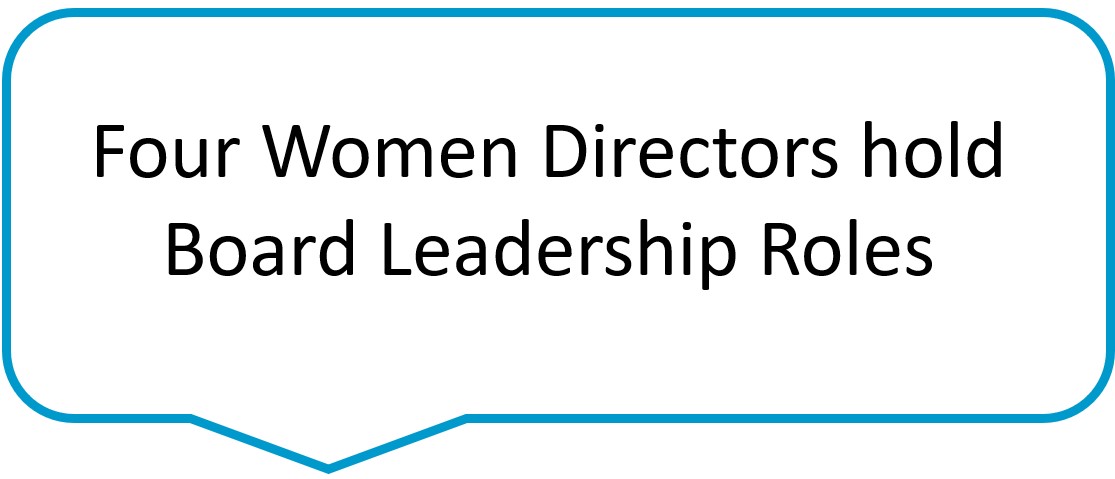

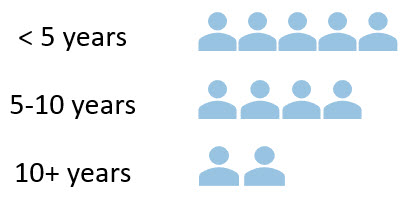

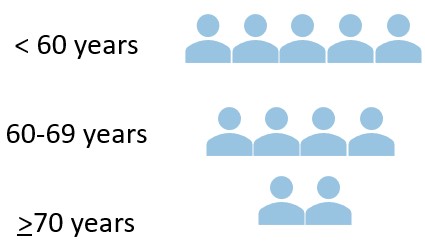

| Director Nominee Highlights | | |

| | | |

| Director succession is a robust, ongoing process at Celanese. Our Board regularly evaluates desired attributes in light of the Company’s strategy and evolving needs. We believe that our director nominees bring a well-rounded variety of skills, qualifications, experience and diversity, and represent an effective mix of deep company knowledge and fresh perspectives. | | |

| | | |

| | | |

| Diversity | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Tenure | | | | | Age | | | | Expertise and Independence | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | |

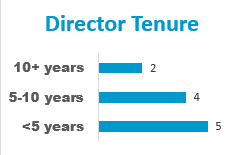

| | Average Tenure: 6 years | | Average Age: 62 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| Balanced Mix of Skills, Qualifications and Experience | | | | | | | | | | | | | | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | | |

| Celanese 2022 / Notice of Annual Meeting and Proxy Statement / 6 |

| | | | | | | | | | | | | | |

| Environmental, Social and Governance Update |

| | | | |

| Accelerating safe and sustainable solutions through chemistry. |

| | | | |

We believe we have a responsibility to meaningfully improve the world through the power of chemistry.

|

| | | | |

| This responsibility to do more is instilled within us at Celanese, and we believe that when chemistry connects with sustainability, the possibilities are endless. |

|

Sustainability Strategy Framework

Celanese is committed to protecting natural resources and helping our partners and their customers to do the same. We use a three-pronged approach to integrate key elements of sustainability into our operational and product strategy:

| | | | | | | | |

| Reducing GHG Emissions in Our Own Operations | Building Solutions to Support Customers’ Sustainability Goals | Improving the Sustainability of Existing Products |

| Example Initiatives: | Example Solutions: | Example Products: |

•New environmental data tracking system to help identify opportunities to support targets •Use of Carbon Capture and Solar Power at the world’s largest acetic acid plant •Heat and power solution at Belgium facility saving approximately 3,100 metric tons of carbon dioxide (CO2) annually •Award winning energy-efficiency checklist used to consider sustainability impact at project inception; Adding sustainability factors to expenditure review process in 2022 | •Improve the efficiency of construction materials (Elotex® redispersible powders) •Are used in solar panels (VAM) •Make automobiles weigh less for better fuel-efficiency •Power electric vehicles (LiBS) •Eliminate pollutive painting, coating, and finishing steps in automotive and other applications •Improve health and well-being with our VitalDose® controlled release long-acting drug delivery solutions | •Pom ECO-B is made from up to 97% certified mass-balance bio-content with up to 50% CO2 reduction •Santoprene™ TPV uses in-process recycling during processing and the finished product has potential to be recycled at end-of-life •BlueRidge™ biodegradable alternative to single-use plastics •Clarifoil® bio-based film used in packaging applications for consumer products •Materials and emulsions made from renewable and recyclable feedstocks |

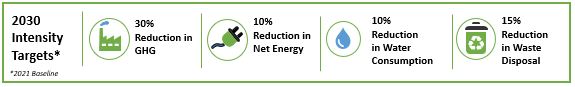

Setting Meaningful Climate and Other Environmental Goals

Climate change is one of the most pressing societal issues of our time, and we made a priority to improve and analyze our greenhouse gas emissions database, evaluate a meaningful reduction target, and develop a greenhouse gas abatement strategy. We are proud to set the below environmental targets measured against a 2021 baseline. This includes our newest goal to reduce Scope 1 and Scope 2 total greenhouse gas intensity by 30% by 2030, measured as metric tons of CO2 equivalent per metric tons of product. We have also committed to better understand our Scope 3 emissions sources to develop a roadmap to identify, quantify, and reduce Scope 3 emissions.

*The intensity targets are based on production from a 2021 baseline for current Celanese owned or operated assets.

As we work to reduce our carbon impact, we are expanding our portfolio of sustainable solutions to help our customers meet their sustainability objectives. Supporting this and our broader growth strategy, we have set intensity-based targets to better reflect the effects of future organic and acquisition opportunities.

Our environmental analytics drive important decision making in areas such as climate, energy, waste, and water. As a result, our greenhouse gas reduction target is focused on capital investment projects and the increased use of renewable energy to help us achieve this goal. For example, key projects ongoing at our Clear Lake, Texas plant, the largest acetic acid plant in the world, include:

| | | | | | | | |

| Celanese 2022 / Notice of Annual Meeting and Proxy Statement / 7 |

•Carbon capture and utilization of waste CO2 to produce additional methanol with lower overall CO2 emissions;

•Solar power energy commitment to supply ~33% of the annual electricity consumption; and

•Acetic acid expansion to maximize raw material efficiencies and establish the ability to further reduce utility steam requirements.

Significant Steps Forward and Achievements in 2021 and Early 2022

Our proactive commitments to robust climate, sustainability governance, and social programs has led to recent significant progress.

■Adopted new goal to reduce Scope 1 and Scope 2 total greenhouse gas intensity by 30% by 2030 (see https://sustainability.celanese.com/News/2022/greenhouse-gas-emissions-reduction)

■Formed working group to develop a roadmap to identify, quantify and reduce Scope 3 emissions

■Implemented a new software system to capture SASB-aligned environmental metrics

■Began tracking ~50% more data points on climate to support goal setting and progress monitoring

■Published a Water Management Policy, which includes conducting local water risk evaluations especially in regions of water stress (available at https://sustainability.celanese.com/News/2022/celanese-formalizes-water-policy)

■Commenced solar energy deployment at Clear Lake plant

■Created a Supplier Risk Management program which evaluates and monitors strategic suppliers that represent approximately 50% of our 2020 spend

■Improved to MSCI ESG “A” rating

■Held a dedicated ESG Enterprise Risk Management (ERM) workshop to further embed sustainability risks into Celanese ERM program risk assessments

■Reached a milestone of 1,000,000 hours volunteered by our employees since the beginning of 2015

■Published comprehensive Sustainability Report, which includes:

–our first SASB-aligned index; and

–our first Task Force on Climate-Related Financial Disclosures (TCFD) index

See “Human Capital Management” beginning on page 49 of this Proxy Statement for additional information about our human capital efforts. Go to https://www.celanese.com/sustainability/ to learn more about Sustainability at Celanese.

| | | | | | | | |

| Celanese 2022 / Notice of Annual Meeting and Proxy Statement / 8 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Governance Highlights | | |

| Our Corporate Governance Policies Reflect Best Practices | | |

| We are committed to good corporate governance, which promotes the long-term interests of shareholders, strengthens Board and management accountability and helps to build public trust in the Company. | | |

| | | |

| | | |

| | | | |

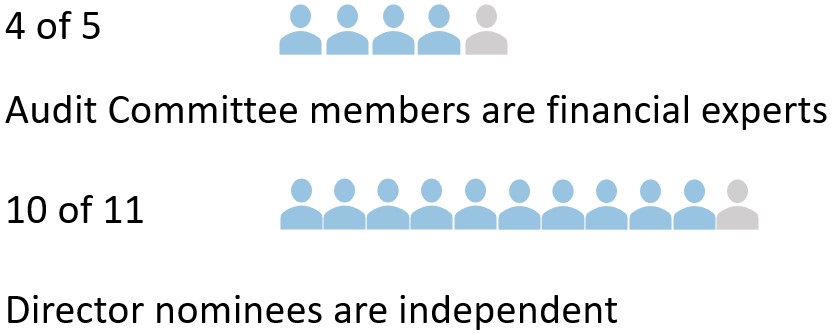

| Independent Oversight | ● 10 of 11 director nominees are independent (all except for the CEO) ● Lead Independent Director with clearly defined and robust responsibilities ● Regular executive sessions of independent directors at Board meetings (chaired by the Lead Independent Director) and Committee meetings (chaired by independent Committee chairs) ● 100% independent Board Committees ● Active Board oversight of the Company’s strategy, risk management and ESG efforts | | |

| | |

| | | | |

| Board Refreshment

| ● Comprehensive, ongoing Board succession planning process ● Focus on diversity (3 of the Board’s 4 committees are chaired by women, who are also independent directors); 6 of 11 director nominees are women, or racially or ethnically diverse) ● Regular Board refreshment and mix of tenure of directors (10 new directors since the beginning of 2012, 7 since the beginning of 2015, 5 since the beginning of 2018 and 2 since the beginning of 2021) ● Annual Board and Committee assessments including performance evaluation of individual directors ● Retirement age of 75 | | |

| | | | |

| Shareholder Rights

| ● Annual election of all directors ● Majority-vote and director resignation policy for directors in uncontested elections ● Proxy access right for shareholders (3% ownership threshold continuously for 3 years / 2 director nominees or 20% of the Board / 20 shareholder aggregation limit) ● Directors may be removed with or without cause ● One class of outstanding shares with each share entitled to one vote ● No poison pill | | |

| | | | |

| Good Governance Practices

| ● Prohibition on hedging or pledging Company stock ● Comprehensive clawback policy ● Rigorous director and executive stock ownership requirements ● Active shareholder engagement program ● Global Code of Conduct applicable to directors and all employees with annual compliance certification ● Political activities disclosures on our website ● Longstanding commitment to corporate responsibility | | |

| | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | |

| Proxy Item No. 2 Ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year ending December 31, 2022 | ü The Board recommends a vote FOR this proposal The Audit Committee and the Board believe that the continued retention of KPMG LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 is in the best interests of the Company and its shareholders. As a matter of good corporate governance, shareholders are being asked to ratify the Audit Committee’s selection of the independent registered public accounting firm for 2022.

àSee “Audit Matters” beginning on page 41 of this Proxy Statement for additional information. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Celanese 2022 / Notice of Annual Meeting and Proxy Statement / 9 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Performance Highlights | |

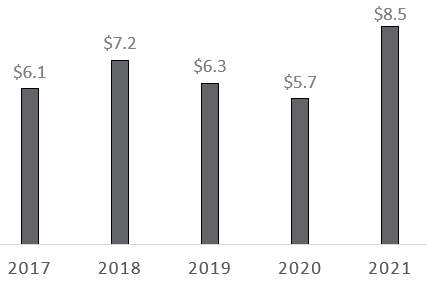

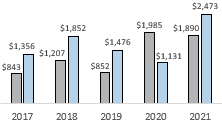

| Business Performance in 2021(see page 46 for more information on our controllable actions to drive performance) | | |

| ü | We reported 2021 net sales of $8.5 billion, 51% higher than 2020 and 36% higher than 2019. | | |

| ü

| Record net sales, together with our successful offsetting of $1.1 billion in raw material, energy and logistics cost inflation during a volatile year, supported: | | |

| | t | GAAP diluted earnings per share of $17.06, and Adjusted EPS(1) of $18.12, the latter surpassing the previous record Adjusted EPS by 65%; | | |

| | t | Net earnings of $1,890 million and Adjusted EBIT(1) of $2,473 million; and | | |

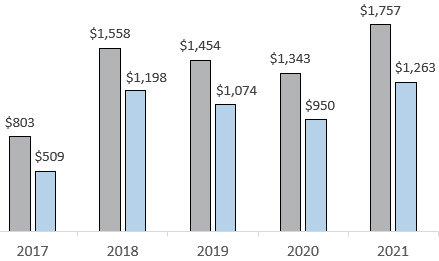

| | t | Operating cash flow of $1,757 million and free cash flow(1) of $1,263 million. | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Advancing our Strategy for Earnings Per Share Growth and Effective Capital Allocation | | |

| In February 2022, we entered into a definitive agreement to acquire the majority of the Mobility & Materials business of DuPont for $11.0 billion in cash. This acquisition, expected to close around the end of 2022, will expand our Engineered Materials business with a broad portfolio of engineered thermoplastics and elastomers, industry-renowned brands and intellectual property, global production assets, and a world-class organization. | | |

| In 2021, we: | | Net Sales ($Bn) | | |

| ü

| completed the acquisition of the Santoprene business, enhancing our Engineered Materials business with an industry-leading team, product portfolio and set of production facilities through effective deployment of capital from the 2020 sale of our interest in Polyplastics; | | | | |

| ü | navigated sourcing and logistics constraints and maintained margin through deliberate commercial actions; and | | | |

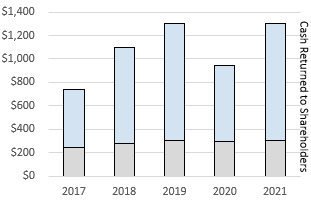

| ü | lifted foundational earnings per share by deploying $2.6 billion to organic investments, M&A and share repurchases, in addition to returning $304 million in cash to shareholders through dividends. | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Cash Flow | Cash Returned to Shareholders | | |

| | | |

| | Operating Cash Flow ($M) | | | | |

| | | | | | |

| | Free Cash Flow ($M) | | |

| | | | | | |

| | Share Repurchases ($M) | | |

| | | | | | |

| | Cash Dividends ($M) | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ü

| Proxy Item No. 3 Advisory Approval of Executive Compensation | ü The Board recommends a vote FOR this proposal Our Board recommends that shareholders vote “FOR” the advisory approval of the compensation of our named executive officers (“NEOs” or “named executive officers”) for the 2021 performance year.

|

| | | |

| Additional Information | | |

| Please see “Questions and Answers” beginning on page 86 for important information about the proxy materials, voting, the Annual Meeting, Company documents, communications and the deadlines to submit shareholder proposals for the 2022 Annual Meeting. | | |

| (1) Adjusted earnings per share, adjusted EBIT and free cash flow are non-U.S. GAAP financial measures. See “Exhibit A” for information concerning these measures including a definition and a reconciliation to the most comparable U.S. GAAP financial measure. | | |

| | | | | | | | |

| Celanese 2022 / Notice of Annual Meeting and Proxy Statement / 10 |

PROXY STATEMENT

For the Annual Meeting of StockholdersShareholders To Be Held Virtually on April 18, 201920, 2022

The boardBoard of directorsDirectors (the “board“Board of directors”Directors” or the “board”“Board”) of Celanese Corporation, a Delaware corporation (the “Company,” “we,” “us” or “our”), solicits the enclosed proxy for use at our 20192022 Annual Meeting of StockholdersShareholders (the “Annual Meeting”) to be held virtually at 7:1:00 a.m.p.m. (Central Daylight Saving Time) on Thursday,Wednesday, April 18, 2019,20, 2022, at The Westin Irving Convention Center at Las Colinas, 400 West Las Colinas Blvd., Irving, Texas 75039.our virtual meeting website www.virtualshareholdermeeting.com/CE2022. This Proxy Statement (this “Proxy Statement”) contains information about the matters to be voted on at the meeting and the voting process, as well as information about our directors. We will bear the expense of soliciting the proxies for the Annual Meeting. |

| | | | | | | | | | | | | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERSSHAREHOLDERS TO BE HELD ON APRIL 18, 201920, 2022 |

The Celanese Corporation 20192022 Notice of Annual Meeting and Proxy Statement, 20182021 Annual Report and other proxy materials are available at www.proxyvote.com. |

INFORMATION ABOUT SOLICITATION AND VOTING

Pursuant to U.S. Securities and Exchange Commission (“SEC”) rules, we have elected to furnish proxy materials to our stockholdersshareholders via the Internet instead of mailing printed copies of those materials to each stockholder.shareholder. If you received a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) by mail, you will not receive a printed copy of the proxy materials unless you request one. Instead, the Notice of Internet Availability will instruct you as to how you may access and review the proxy materials and cast your vote on the Internet. If you received a Notice of Internet Availability by mail and would like to receive a printed copy of our proxy materials, please follow the instructions included in the Notice of Internet Availability. StockholdersShareholders who requested paper copies of proxy materials or previously elected to receive proxy materials electronically will not receive the Notice of Internet Availability and, instead, will receive the proxy materials in the format requested. This Proxy Statement, our 20182021 Annual Report and other information about the Annual Meeting also are available in the investor relations“News & Events” section of our website, https://investors.celanese.com.

The Notice of Internet Availability and, for stockholdersshareholders who previously requested electronic or paper delivery, the proxy materials will be made availablemailed on or about March 8, 2019,10, 2022, to stockholdersshareholders of record and beneficial owners who owned shares of the Company’s Common Stock (“Common Stock”) at the close of business on February 19, 2019.22, 2022.

Our principal executive offices are located at 222 W. Las Colinas Blvd., Suite 900N, Irving, Texas 75039.

For additional information about the proxy materials and the Annual Meeting, see “Questions and Answers”.

|

| | |

| Celanese 2019 / Notice of Annual Meeting and Proxy Statement / 8 |

|

| | | | | | |

| | Celanese 2022 / Notice of Annual Meeting and Proxy Statement / 11 |

GOVERNANCE

The Company is committed to effective corporate governance, which promotes the long-term interests of stockholders,shareholders, strengthens boardBoard and management accountability and helps build public trust in the Company. See “Corporate Governance Highlights” for more information. The Company’s certificate of incorporation, by-laws, corporate governance guidelines, boardBoard committee charters and other materials can be accessed on our website, https://investors.celanese.com, by clicking “Corporate Governance.” Instructions on how to obtain copies of these materials are also included in the response to question 2320 in the Questions and Answers section on page 8992. ITEM 1: Election of Directors

Background

Based on the recommendation of our independent nominatingNominating and corporate governance committee,Corporate Governance Committee (the “N&CG Committee”), our boardBoard of directorsDirectors has nominated nineeleven directors — Jean S. Blackwell, William M. Brown, Edward G. Galante, Rahul Ghai, Kathryn M. Hill, David F. Hoffmeister, Dr. Jay V. Ihlenfeld, Mark C. Rohr,Deborah J. Kissire, Michael Koenig, Kim K.W. Rucker and John K. Wulff,Lori J. Ryerkerk — to serve a one-year term expiring at the 20202023 Annual Meeting of Stockholders.Shareholders. These director nominees have consented to be elected to serve as directors for the next year.

At the Annual Meeting, youshareholders will have the opportunity to elect these nominees. Unless otherwise instructed, the proxy holders will vote the proxies received by them for these nineeleven nominees. If any of our nominees is unable or declines to serve as a director as of the time of the Annual Meeting, the boardBoard may designate a substitute nominee or reduce the size of the board.Board. Proxies will be voted for any nominee who shall be designated by the boardBoard of directorsDirectors to fill the vacancy.

The name of each of our nominees for election and certain information about them, as of the date of this Proxy Statement (except ages, which are as of the date of the Annual Meeting), is set forth below. Included in the information below is a description of the particular qualifications, attributes, skills and experience that led the boardBoard to conclude that each person below should serve as a director of the Company.

|

| | | | | | | | | | | | | | | | | | | |

| Board Composition and Refreshment | | | BOARD REFRESHMENT | | |

| | | | | | Over the last five years: |

Ensuring theBuilding a board that is composed of directors who bring diverse viewpoints and perspectives, exhibit a variety of skills, professional experience and backgrounds, and effectively represent the long-term interests of our stockholders,shareholders, is a principleprincipal priority of the boardBoard and the nominatingN&CG Committee. The Board and corporate governance committee. The board and the committeeCommittee also understand the importance of boardBoard refreshment, and continuously strive to maintain an appropriate balance of tenure, turnover, diversity and skills on the board.skills. The boardBoard believes that new perspectives and new ideas are critical to a forward-looking and strategic board, as is the ability to benefit from the valuable experience and familiarity with the complexities of our business that longer-serving directors bring. The Board regularly evaluates the skills represented on the Board. | | | | BOARD REFRESHMENT | |

| | Under Mark Rohr’s leadership of the board since 2012 |

| ● | | • | SixFive new directors elected, three of whom are women and two of whom are racially or ethnically diverse |

| | •● | Rotation of all boardBoard committee chairs |

| | •● | New lead independent director electedBoard leadership transition and two successive Lead Independent Directors |

| | •● | Expanded qualificationsprofessional experience and diversity represented on the boardBoard |

| | •● | Transitioned to annual election of directors |

| | | | | |

| | | | | |

| | | | | |

| |

| | | | |

|

| | |

| Celanese 2019 / Notice of Annual Meeting and Proxy Statement / 9 |

|

| | | | | | |

| | Celanese 2022 / Notice of Annual Meeting and Proxy Statement / 12 |

The election of Messrs. Ghai and Koenig to the Board in February 2022 was the result of a strategic succession planning effort by the Board and the N&CG Committee to bring additional materials industry experience, to enhance the global perspective of our Board given our increasingly global footprint, and bring additional operating and financial expertise following the retirement of John Wulff after more than 14 years of service. The N&CG Committee engaged a search firm to identify qualified candidates. This firm identified Messrs. Ghai and Koenig, among other candidates, as qualified nominees. The N&CG Committee and the full Board carefully reviewed the experience, skills and attributes of Messrs. Ghai and Koenig, along with those of a number of other qualified candidates, as well as their independence. After interviews, the N&CG Committee and the Board determined to elect each of them to the Board in February 2022 and to recommend to our shareholders that they be elected at the 2022 Annual Meeting.

Qualifications Required of All Directors

The boardBoard and the nominating and corporate governance committeeN&CG Committee require that each director be a recognized person of high integrity with a proven record of success in his or her field and have the ability to devote the time and effort necessary to fulfill his or her responsibilities to the Company. Each director must demonstrate innovative thinking, familiarity with and respect for corporate governance requirements and practices, a willingness to assume fiduciary responsibilities, an appreciation of diversity and a commitment to sustainability and to dealing responsibly with social issues. In addition, the boardBoard conducts interviews of potential director candidates to assess integral qualities, including the individual’s ability to ask difficult questions and, simultaneously, to work collegially.

The board does not have a defined diversity policy, butBoard considers diversity of race, ethnicity, gender, age, cultural background and professional experience in evaluating candidates for board membership.Board membership and assesses the effectiveness of this policy through the N&CG Committee’s annual review of director nominees. The boardBoard believes that diversity results in a variety of points of view and, consequently, a more effective decision-making process. The Board has added three women directors and two racially/ethnically diverse directors in the last five years.

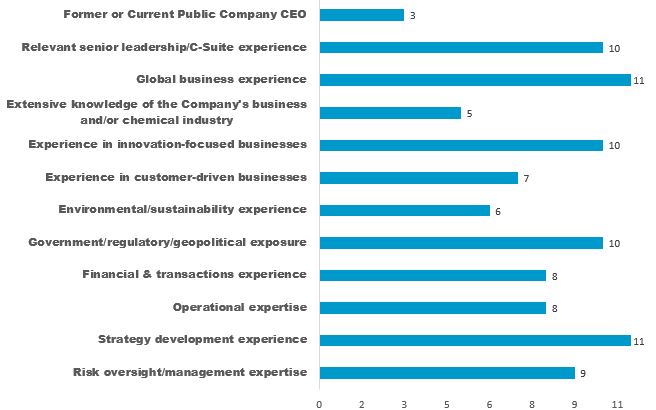

Qualifications, Attributes, Skills and Experience to be Represented on the Board

The boardBoard has identified particular qualifications, attributes, skills and experience that are important to be represented on the boardBoard as a whole, in light of the Company’s current and expected future business needs. TheThese are summarized in the following table summarizes certain characteristics of the Company and the associated qualifications, attributes, skills and experience that the board believes should be represented on the board.table.

| | | | | | | | | | | | | | | | | | | | |

| Qualifications, Attributes, Skills

and Experience | | Characteristics | No. of Directors |

| & | Relevant senior leadership/C-Suite experience | | Senior leadership experience allows directors to better understand day-to-day and strategic aspects of a business | 10 |

| Q | Global business experience | | Our business is global and multicultural, with products manufactured in the Americas, Europe and Asia and operations in 18 countries around the world | 11 |

| . | Extensive knowledge of the Company’s business and/or chemical industry | | A deep understanding of the Company’s business and/or the chemical industry allows a director to better guide the Company | 5 |

| : | Experience in innovation-focused businesses | | Focus on innovation to drive performance | 10 |

| 5 | Experience in customer-driven businesses | | High level of customer interaction | 7 |

| Ð | Environmental/sustainability experience | | Experience with complex environmental regulation and sustainability-focused strategy | 6 |

| G | Government/regulatory/geopolitical exposure | | Regulatory obligations and political challenges in various jurisdictions | 10 |

| q | Financial & transactions experience | | High level of familiarity with financial matters and complex financial transactions, including in foreign countries / currencies | 8 |

| @ | Operational expertise | | Experience managing manufacture of many types and kinds of products consistent with high level specifications and in large quantities | 8 |

| 6 | Strategy development experience | | Experience with strategy development, allowing the Board to better evaluate management’s plan and guide the Company | 11 |

| L | Risk oversight/management expertise | | Assessment of risk and the policies/procedures to manage risk | 9 |

|

| | | | | | | | | | | | | | | | |

| Qualifications, Attributes, Skills and Experience | | CharacteristicsRecently-Elected Directors Enhance Key Expertise |

&● | Relevant senior leadership/C-SuiteActing Executives (CEO and CFO of multibillion dollar companies) | ● | Financial Transactions and Capital Markets |

| ● | Deep Chemical and Materials industry executive experience | ● | Senior leadership experience allows directors to better understand day-to-dayAudit, Financial Reporting and strategic aspects of a business |

Q | Global business experience | | The Company’s business is global and multicultural, with products manufactured in the Americas, Europe and Asia and operations in 18 countries around the world |

. | Extensive knowledge of the Company’s business and/or chemical industry | | A deep understanding of the Company’s business and/or the chemical industry allows a director to better guide the Company |

: | Experience in innovation-focused businesses | | Focus on innovation to drive performance |

5 | Experience in customer-driven businesses | | High level of customer intimacy |

| High level of financial experience | | Multi-dimensional businesses in multiple chemical segments |

G | Government/regulatory/geopolitical exposure | | Regulatory obligations and political challenges in various jurisdictions around the globe |

q | Financial transactions experience | | Complex financial transactions, including those in different countries and currencies |

@ | Operational expertise | | Ability to manufacture many types and kinds of products consistent with high level specifications and in large quantities |

6 | Strategy development experience | | Experience with strategy development, allowing the board to better evaluate management’s plan and guide the Company |

L | Risk oversight/management expertise | | Assessment of risk and the policies/procedures to manage riskManagement |

|

| | |

| Celanese 2019 / Notice of Annual Meeting and Proxy Statement / 10 |

|

| | | | | | |

| | | | | Governance | Celanese 2022 / Notice of Annual Meeting and Proxy Statement / 13 |

Director Nominees

Director Nominees

| | | | | | | | | | | | | | | | | | | | | | | |

| Jean S. Blackwell |

| |

| Ms. Blackwell served as Chief Executive Officer of Cummins Foundation and Executive Vice President, Corporate Responsibility, of Cummins Inc., a leading global power leader that designs, manufactures, distributesdesigner, manufacturer, distributor and services diesel and natural gasservicer of engines and engine-related component products, from March 2008 until her retirement in March 2013. She previously served as Executive Vice President and Chief Financial Officer from 2003 to 2008, and had previous roles as Vice President, Cummins Business Services from 2001 to 2003,fr Vice President, Human Resources, from 1998 to 2001, and Vice President and General Counsel from 1997 to 1998 of Cummins Inc. Prior thereto, Ms. BlackwellCounsel. Previously, she was a partner at the Indianapolis law firm of Bose McKinney & Evans LLP from 1984 to 1991, where she practiced in the areaareas of financial and real estate transactions. She has also served in state government, including as Executive Director of the Indiana State Lottery Commission and State of Indiana Budget Director. Ms. Blackwell has served as a member of the board of directors of Ingevity Corporation, a leading global manufacturer of specialty chemicals and high performance carbon materials, since May 2016, including as the chair of the audit committee andBoard, as a member of its compensation committee and nominating, governance and sustainability committee, and previously as chair of the executiveaudit committee. Ms. Blackwell has also served as a member of the board of directors of Johnson Controls International plc, a leading diversified technology company, since May 2018, including as a member of its compensation committee and as chair of the governance and sustainability committee. She previously served as a member of the board of directors from April 2004 to November 2009, and as chair of the audit committee, of Phoenix Companies Inc., a life insurance company. Ms. Blackwell also served as a member of the board of directors of Essendant Inc. (formerly United Stationers Inc.), a leading national wholesale distributor of business products, from 2007-2018, including as a memberchair of the governance committee and the audithuman resources committee, and as the chaira member of the human resource committee and the governanceaudit committee. |

| | | | | | |

Director since: 2014 Age: 6467 Current Board Committees: CompensationAudit

Nominating and Corporate Governance Other Public Company Boards: Ingevity Corporation Johnson Controls International plc Essendant Inc. (2007-2018) Phoenix Companies Inc. (2004-2009) | | | | | Specific Qualifications, Attributes, Skills and Experience: |

| & | Q | 5 | Â | Substantial global leadership, operational, financial, transactional, strategic, customer-driven, and risk management experience gained as Executive Vice President/CFO and General Counsel of Cummins Inc., and service on other boards of directors. |

| q | @ | L6 |

| L | | |

| G | | | Substantial governmental experience from having served in the Indiana State Government. |

| Ð | | | Substantial environmentally-focused strategic experience from tenure as Executive Vice President, Corporate Responsibility of Cummins Inc. |

| | | | | |

| | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | |

| William M. Brown |

| |